futuresapp.ru

Learn

Best Time To Buy Term Life Insurance

Generally speaking, when a term life policy comes to the end of its term (or effective period), you either have to buy another policy (at a higher cost) or go. Flexible. Premiums are based on your age when you buy the policy. Most policies let you change your premium payments, but it will affect your death benefit. The day after you get married or have your first child. As dependents are added, then increase your policy. It could cover a mortgage. A family. A business. College tuition. Caring for a parent. Now's the time to plan ahead. Graph showing how term life insurance needs. Because life insurance is a personalized product, the best time to buy it is as soon as you realize you need it. For example, some people purchase life. Keep in mind that premiums are lowest when you are young and increase upon renewal as you age. Some term insurance policies can be renewed when the policy ends. Experts recommend that term plans should cover you till you reach 65 years. A term plan that fulfils all of your financial needs is the best in your list. It is. It depends on their age. Insurance companies seta maximum age limit for term life insurance policies. This is usually 80 to 90 years old, but may be higher or. What's the best time of year to buy life insurance? · New year, new insurance · Tax season · Summer vacation · Consider if you have children: · Think about travel. Generally speaking, when a term life policy comes to the end of its term (or effective period), you either have to buy another policy (at a higher cost) or go. Flexible. Premiums are based on your age when you buy the policy. Most policies let you change your premium payments, but it will affect your death benefit. The day after you get married or have your first child. As dependents are added, then increase your policy. It could cover a mortgage. A family. A business. College tuition. Caring for a parent. Now's the time to plan ahead. Graph showing how term life insurance needs. Because life insurance is a personalized product, the best time to buy it is as soon as you realize you need it. For example, some people purchase life. Keep in mind that premiums are lowest when you are young and increase upon renewal as you age. Some term insurance policies can be renewed when the policy ends. Experts recommend that term plans should cover you till you reach 65 years. A term plan that fulfils all of your financial needs is the best in your list. It is. It depends on their age. Insurance companies seta maximum age limit for term life insurance policies. This is usually 80 to 90 years old, but may be higher or. What's the best time of year to buy life insurance? · New year, new insurance · Tax season · Summer vacation · Consider if you have children: · Think about travel.

You're able to select a term policy for a period of time that works best for your needs, such as 10, 20, or 30 years. Term life is affordable. Know your company: Check the financial stability of the insurance company. There are several reputable rating companies that will help you do this. Some of. If you have debts or dependents, or are even just thinking about them, it may be a good time to get term life insurance. Is there a best time to buy life insurance? · You are married, or soon to be · You have children, or about to start a family · You are a homeowner, or will be soon. It's never too soon to buy insurance. You'll be more likely to pay a standard premium when you're still young and healthy. Read more: 3 reasons. What's the best time of year to buy life insurance? · New year, new insurance · Tax season · Summer vacation · Consider if you have children: · Think about travel. I only recommend TERM life insurance. Why? You get the same amount of coverage for a fraction of the price of a whole life policy. A term policy. However, it's important to keep your future goals in mind and decide if the cost of waiting is worth it to you. Considering that most people can purchase a term. Fixed Term: Fixed term is the most popular choice. It's the most basic version and lasts 10, 20, or 30 years long. The premiums remain static in this plan. 1. What is term life insurance, and how does it work? · 2. How much will term life insurance cost? · 3. How much term life insurance does a person need? · 4. When. If you can fit the monthly premium into your budget, your 20s are the best time to buy affordable term life insurance coverage. If you have a spouse and. Your 20s are the best time to buy affordable term life insurance coverage. Generally, when you're younger and healthier, you pose less risk to an insurer. Many financial experts see life insurance as a tool to "buy time" until you WHEN SHOULD YOU PURCHASE LIFE INSURANCE? People sometimes delay. It depends on their age. Insurance companies seta maximum age limit for term life insurance policies. This is usually 80 to 90 years old, but may be higher or. Term life insurance is coverage for a specific period of time—typically, you can choose periods of one, 10, 15, or even 20 years. It offers a death benefit. Life events like buying a new home, having a baby, approaching retirement, or getting a promotion could be a good time to reconsider your life insurance needs. But notice how once you pass 35, the increased cost of life insurance starts getting noticeable. Therefore, around age 30 is the ideal time to lock in the best. Generally speaking, the best time to buy term insurance would be when you are young and in good health. When we buy a term insurance cover early in life, the. However, if you have a serious health condition that would make a new life insurance policy difficult or nearly impossible to get, converting your term life. When you are young and have many milestones ahead of you, both financial and personal, a longer term length can buy you the flexibility you need. Plus, you can.

Can You Use A Debit Card To Book A Hotel

:max_bytes(150000):strip_icc()/businesspeople-checking-in-to-hotel-in-the-lobby-683781150-5c2f92b146e0fb0001633fe7.jpg)

If you are booking without a credit card, you can use a debit card, pay cash, make a PayPal transaction, or use a prepaid card to make your reservation. Use your Virtual Visa Debit card to shop anywhere Visa is accepted online. You can also use it to pay your bills such as utilities and CRA, and set up recurring. You can book a hotel room without a credit card by using a debit card in most cases. Many hotel chains will also accept prepaid cards, though they are more. To book a reservation, guests are required to provide a credit / debit card number as a guarantee. There won't be any charges to the card if the reservation is. I work at a hotel and I use my debit card to book rooms almost every month. Never had an issue. My deposit is returned within 24 hours. Some. Most locations accept debit cards, but some rental partners have different requirements. Some rental companies may allow a debit card to be used for the deposit. Yes, you can book a hotel with your Visa Debit card. While using a debit card, the amount will be debited instantly from your account. The advantage of using a debit card when booking a hotel room is that the funds will be taken directly from your checking account when you make the payment for. Visa and MasterCard debit cards use a number that most reservation systems will identify as a regular credit card number. Therefore you should be able to get. If you are booking without a credit card, you can use a debit card, pay cash, make a PayPal transaction, or use a prepaid card to make your reservation. Use your Virtual Visa Debit card to shop anywhere Visa is accepted online. You can also use it to pay your bills such as utilities and CRA, and set up recurring. You can book a hotel room without a credit card by using a debit card in most cases. Many hotel chains will also accept prepaid cards, though they are more. To book a reservation, guests are required to provide a credit / debit card number as a guarantee. There won't be any charges to the card if the reservation is. I work at a hotel and I use my debit card to book rooms almost every month. Never had an issue. My deposit is returned within 24 hours. Some. Most locations accept debit cards, but some rental partners have different requirements. Some rental companies may allow a debit card to be used for the deposit. Yes, you can book a hotel with your Visa Debit card. While using a debit card, the amount will be debited instantly from your account. The advantage of using a debit card when booking a hotel room is that the funds will be taken directly from your checking account when you make the payment for. Visa and MasterCard debit cards use a number that most reservation systems will identify as a regular credit card number. Therefore you should be able to get.

Payments by futuresapp.ru facilitates your guest payments, then pays you via bank transfer or virtual credit card (VCC). A VCC is a temporary digital Mastercard. Upon check-in, your card issuing bank will place a hold on your debit or credit card for room & tax charges, any applicable resort fees, plus an amount for. Yes, a credit card is required for all reservations made via the Internet. To protect against the unauthorized use of your credit card, the reservations process. Hotels generally accept any Debit/Credit Card or you can even pay by cash. It doesn't have to be the same card, whether you booked it through. Don't use a debit card—but if you must, make sure you have enough money in your bank account. Using a debit card for a hotel room isn't wise for several. You can book a hotel room without a credit card by using a debit card in most cases. Many hotel chains will also accept prepaid cards. Instead Maestro card can be used at check-out time when the final amount is determined. How do I know if it is Debit Mastercard or a Maestro? Debit. Yes, a hotel can take money from a debit card, as many hotels accept debit cards as a form of payment. It is common for hotels to require either a credit card. I use my credit card sparingly: to book reservations by phone (for hotel Minimizing debit- and credit-card use also guards against card fraud or theft. When a guest pays online, we facilitate their payment and load it onto a virtual credit card (VCC). · This card is activated and can be charged—as you would any. Hotels will require a credit card authorization to guarantee payment of any incidental charges that you may incur during the stay. The amount of available. What happens if I use a debit card to book my reservation? Debit cards will be processed and charged at the time of check-in. This authorization will hold. Upon check-in, your card issuing bank will place a hold on your debit or credit card for room & tax charges, any applicable resort fees, plus an amount for. We do not accept cash deposits or debit cards at check-in. Payment Policy. If you are paying by credit card hotel for a credit card authorization link. The credit or debit card used at the time of the booking will be used by the hotel to guarantee the reservation. However, if you have booked a room or room &. Pay by credit or debit card. The easiest way to pay for a hotel booking online is by using a credit card. You will need a credit card number to make a. The hotel accepts credit and debit cards with security chips as payment and deposits. Payment cards will be authorized for the full amount of your stay plus. A credit/debit card is needed to hold your reservation; you will not be charged at the time of booking unless stated · If you have booked a rate that requires a. Booking hotel reservations online always require you to give your credit card information. This is the only possible way for the booking to push through. Step 5. Credit cards may also be necessary when booking a hotel stay or car rental. Also, many credit cards offer travel-related perks for purchases, which can.

Mexico Bank Interest Rates

1/ Interest rate target for overnight funding operations between banks. 2/ The overnight TIIE funding rate is calculated by Banco de México using repo. Mexico: Markets ; Lending Rate, 06 Sep , ; Stock Market Index, 06 Sep , 51, ; Treasury Bills (over 31 days), 05 Sep , ; Average Long-term. Current information about the Banco de México securities prices and interest rates. Interest rates on bank credit to the private sector The latest value from is percent, an increase from percent in In comparison, the. Mexico Interest Rate Decision ; Actual: % ; Forecast: % ; Previous: %. BBVA Bancomer today completed the settlement of an interest-rate swap denominated in Mexican pesos, making it the first Mexican bank to settle transactions. 3/ The Interbank Equilibrium Interest Rate (TIIE) is calculated by Banco de México using commercial bank quotes as stipulated in the Annex 1 of Official Gazette. Bank deposit interest rate, percent in Mexico, June, The most recent value is percent as of June , an increase compared to the previous value. The benchmark interest rate in Mexico was last recorded at percent. Interest Rate in Mexico is expected to be percent by the end of this quarter. 1/ Interest rate target for overnight funding operations between banks. 2/ The overnight TIIE funding rate is calculated by Banco de México using repo. Mexico: Markets ; Lending Rate, 06 Sep , ; Stock Market Index, 06 Sep , 51, ; Treasury Bills (over 31 days), 05 Sep , ; Average Long-term. Current information about the Banco de México securities prices and interest rates. Interest rates on bank credit to the private sector The latest value from is percent, an increase from percent in In comparison, the. Mexico Interest Rate Decision ; Actual: % ; Forecast: % ; Previous: %. BBVA Bancomer today completed the settlement of an interest-rate swap denominated in Mexican pesos, making it the first Mexican bank to settle transactions. 3/ The Interbank Equilibrium Interest Rate (TIIE) is calculated by Banco de México using commercial bank quotes as stipulated in the Annex 1 of Official Gazette. Bank deposit interest rate, percent in Mexico, June, The most recent value is percent as of June , an increase compared to the previous value. The benchmark interest rate in Mexico was last recorded at percent. Interest Rate in Mexico is expected to be percent by the end of this quarter.

Mexico Interest Rate Decision ; Actual: % ; Forecast: % ; Previous: %.

Interest Rates, Discount Rate for Mexico. Percent per Annum, Monthly Federal Reserve Bank of St. Louis, One Federal Reserve Bank Plaza, St. Louis. Mexico: Markets ; Lending Rate, 06 Sep , ; Stock Market Index, 06 Sep , 51, ; Treasury Bills (over 31 days), 05 Sep , ; Average Long-term. The consensus forecast for Central Bank Interest Rate is 11%. A higher value than forecast tends to be bullish for MXN/xxx pairs and bearish for xxx/MXN pairs. The Banxico Target Rate ended at %, higher than the % end value and significantly above the rate of % a decade earlier. Mexico has lowered its interest rates by percentage points, from 11% to an annual rate of %. Current information about the Banco de México securities prices and interest rates. rate mechanism and no longer intervened in the peso exchange rate through tough policies. When the Bank of Mexico makes interest rate decisions, it now. Mexico [IR3TIB01MXMN], retrieved from FRED, Federal Reserve Bank Interest Rates Money, Banking, & Finance Indicators Mexico Countries International Data. The current lending interest rate in Mexico is about % APR. Last Updated 3/06/ This lending rate, calculated daily by the Bank of Mexico. Bank deposit interest rate, percent in Mexico, June, The most recent value is percent as of June , an increase compared to the previous value. Deposit Interest Rate in Mexico remained unchanged at percent in March. Deposit Interest Rate in Mexico averaged percent from until In the latest reports, Mexico Interbank Equilibrium Interest Rate: 91 Days TIIE: Month End was reported at % pa in Aug · Its Long Term Interest Rate. Mexico Interest Rate was % in futuresapp.ru provides actual data on the actual cash rate at which Mexican Central Bank lends money to. Researchers measured the impact of different interest rates loan take-up, amount, and repayment rates among female clients of Compartamos Banco in Mexico. Interest Rates, Discount Rate for Mexico. Percent per Annum, Monthly, Not Bank's Net Interest Margin for Mexico. Percent, Annual, Not Seasonally. What is the forecast for Mexico Central Bank Interest Rate? The consensus for the next Mexico Central Bank Interest Rate is unknown, and the last deviation was. Deposit interest rate (%) - Mexico from The World Bank: Data. Average interest rates on loans in Mexico hover around 25 percent and are some of the highest in Latin America. In general, small and medium-sized enterprises . Banxico Overnight Interbank Target Rate - Mexico Mexican Central Bank interest rate This page shows the current and historic values of the Overnight Interbank. Mexico's central bank has hiked the interest rate by percent in order to counterbalance inflation and boost the peso.

Warranty On New Mercedes

The factory new vehicle limited warranty coverage for new Mercedes-Benz models covers material and craftsmanship defects for 48 months or 50, miles. After the initial New Vehicle Limited Warranty expires at 50, miles, the Mercedes-Benz Extended Warranty takes over and provides an additional 1, 2, or 3. Material or workmanship defects are covered for 48 months or 50, miles, whichever comes first. MBCPO Limited Warranty coverage will then apply for 12 additional months for unlimited miles. If the New Vehicle Warranty has expired prior to MBCPO purchase. No Charge: Warranty repair will be made at no charge for parts and labor when performed at an authorized Mercedes-Benz Center (Passenger Car, Light Truck or. Receive the latest news, special offers and exclusives. Your email address. This Mercedes-Benz new vehicle limited warranty covers your new vehicle for 50, miles or 4 years, whichever comes first. If the car is sold before the. Your new Mercedes-Benz is covered by the New Vehicle Limited Warranty. Material or workmanship defects are covered for 48 months or 50, miles, whichever. Vehicle Reserve Program Contact Us. Sales Phone Number Contact Us. The factory new vehicle limited warranty coverage for new Mercedes-Benz models covers material and craftsmanship defects for 48 months or 50, miles. After the initial New Vehicle Limited Warranty expires at 50, miles, the Mercedes-Benz Extended Warranty takes over and provides an additional 1, 2, or 3. Material or workmanship defects are covered for 48 months or 50, miles, whichever comes first. MBCPO Limited Warranty coverage will then apply for 12 additional months for unlimited miles. If the New Vehicle Warranty has expired prior to MBCPO purchase. No Charge: Warranty repair will be made at no charge for parts and labor when performed at an authorized Mercedes-Benz Center (Passenger Car, Light Truck or. Receive the latest news, special offers and exclusives. Your email address. This Mercedes-Benz new vehicle limited warranty covers your new vehicle for 50, miles or 4 years, whichever comes first. If the car is sold before the. Your new Mercedes-Benz is covered by the New Vehicle Limited Warranty. Material or workmanship defects are covered for 48 months or 50, miles, whichever. Vehicle Reserve Program Contact Us. Sales Phone Number Contact Us.

This Mercedes-Benz new vehicle limited warranty covers your new vehicle for 50, miles or 4 years, whichever comes first. If the car is sold before the. Corrosion protection, powertrain protection, and Roadside Assistance are all included. Browse Our New InventoryContact Us. Mercedes-Benz Extended Warranty. With any new vehicle from our inventory, you'll receive the Mercedes-Benz Warranty. This standard coverage lasts for up to 48 months of 50, miles. The warranty on a new Mercedes-Benz lasts for 4 years or 50, miles, whichever comes first. This coverage includes a wide range of components, providing peace. The Mercedes-Benz warranty covers any defects in materials or workmanship, bumper-to-bumper, for the first 48 months or 50, miles, whichever occurs first. The factory new vehicle limited warranty coverage for new Mercedes-Benz models covers material and craftsmanship defects for 48 months or 50, miles. Additional benefits of the Mercedes-Benz Extended Limited Warranty plan include2: · Saves money and time on unexpected repairs; no deductibles, cumbersome. This warranty will only be for the remaining portion of the New Vehicle Limited Warranty or 12 months with unlimited mileage, whichever is longer from the date. The Mercedes-Benz new vehicle limited warranty is good for 4 years/50, miles and includes coverage for powertrain systems, corrosion, and roadside assistance. Every new Mercedes-Benz is backed by the Mercedes-Benz warranty. This limited comprehensive coverage protects you against defects in materials or. Coverage lasts for 48 months or 50, miles, whichever comes first. It's also transferable if you decide to sell your vehicle. Every Certified Pre-Owned Mercedes-Benz is backed by the remaining 4-year/50,mile New Vehicle Limited Warranty. Once that expires, the CPO Limited Warranty. While every new Mercedes-Benz comes with a complimentary New Vehicle Limited Warranty Discuss Mercedes-Benz Extended Warranty Costs at Mercedes-Benz. When you buy a new Mercedes-Benz vehicle, it's protected by the Mercedes-Benz New Vehicle Warranty. This warranty safeguards you against material and. New Vehicle Warranty. All new Mercedes-Benz vehicles are covered by our New Vehicle Warranty. It covers defects in material or workmanship for month or. (MBC) warrants to the original and each subsequent owner of a new Mercedes-. Benz vehicle that any authorized. Mercedes-Benz dealer will make any repairs or. This Extended Limited Warranty (“Agreement”) only applies to covered repairs to the vehicle occurring within the United States and Puerto Rico. The Mercedes-Benz New Vehicle Warranty covers material and craftsmanship defects for 48 months or 50, miles and comes with every new Mercedes-Benz. Basic Limited Warranty. 3-year/36,mile warranty. Basic coverage for three years or 36, miles, whichever comes first. Excludes normal maintenance and wear. Fortunately, the New Vehicle Limited Warranty offers coverage for up to months or 50,miles, whichever comes first. This warranty is offered on all new.

Does Tinder Really Work For Hookups

Just because you're both using Tinder to get laid, doesn't mean you're going to have sex with her that night. It doesn't work like that. You're not entitled to. Tinder is one of the most used dating apps. It's commonly used to find casual hookups over long-term relationships. The short answer is no! Whether you're a man or a woman, there are plenty of people who use Tinder to find more serious relationships. So, to answer your question, yes, Tinder does work in India if you know how to create an outstanding profile and if you have skills carry out an. So, based on the male experience, yes, it is a hookup app. It's not the platform's fault that heterosexual communication is complicated. Tinder is one of the most used dating apps. It's commonly used to find casual hookups over long-term relationships. Yes, absolutely. Other apps are promising--especially Bumble--but Tinder has the quantity. If dating is a numbers game, you're more likely to win on Tinder. Unless you've been living under a rock, you know how this part works: Swipe right if you're into someone and left if you're not. Your thumb is judge, jury, and. Anyway, I don't think I'd be able to convince you that you would probably do quite well in the dating world and that there really is nothing to be so besorgt. Just because you're both using Tinder to get laid, doesn't mean you're going to have sex with her that night. It doesn't work like that. You're not entitled to. Tinder is one of the most used dating apps. It's commonly used to find casual hookups over long-term relationships. The short answer is no! Whether you're a man or a woman, there are plenty of people who use Tinder to find more serious relationships. So, to answer your question, yes, Tinder does work in India if you know how to create an outstanding profile and if you have skills carry out an. So, based on the male experience, yes, it is a hookup app. It's not the platform's fault that heterosexual communication is complicated. Tinder is one of the most used dating apps. It's commonly used to find casual hookups over long-term relationships. Yes, absolutely. Other apps are promising--especially Bumble--but Tinder has the quantity. If dating is a numbers game, you're more likely to win on Tinder. Unless you've been living under a rock, you know how this part works: Swipe right if you're into someone and left if you're not. Your thumb is judge, jury, and. Anyway, I don't think I'd be able to convince you that you would probably do quite well in the dating world and that there really is nothing to be so besorgt.

Tinder users, dating experts and really work out if the flame-emoji app knows our own brains better than we do. How exactly does Tinder work? For anyone that is. An actual relationship is possible to achieve via Tinder. Although it may be rare and only few really say that they met on Tinder, it's definitely possible. We're not just for dating Find someone you actually want to date, then go ahead and Make the First Move. Make genuine connections, vibe over what you both. But whatever the reason you joined Tinder, make sure your profile is nicely set up, and the Tinder algorithm will do safe rest of the work for you. Tinder is. Tinder is a location-based dating app that lets you swipe, match, and exchange messages with local singles. Most people just use it to hook up, but plenty of people have found long term partners there, whether or not that's what they looking for. Tinder is an online dating app that was launched by Sean Rad in Los Angeles, back in While most users primarily use it on their mobile devices, you can. MATCH, CHAT & DATE. IT STARTS WITH A SWIPE™. With 97+ billion matches to date, Tinder® is the top free dating app and the best place to meet new people. With 43 billion matches to date, Tinder® is the world's most popular dating app, making it the place to meet new people. So, to answer your question, yes, Tinder does work in India if you know how to create an outstanding profile and if you have skills carry out an. > How dating app algorithms work. This section is full of mistakes I think the barrier to making new dating apps is actually rather low, as. Tinder is one of the most popular dating apps in the world for people looking for serious relationships, casual hookups, a one night stand, and friendships. I scrolled through hundreds and hundreds of guys but I actually found my life partner. My needle in a haystack. The app works if you do. ♀️ I also. Match is made for long-lasting relationships, while Tinder is your path to quick hookups. work upfront, although not as much as eharmony and other premium. Tell the truth, the whole truth, and nothing but the truth. Being a truth-teller is sexy, and it's the right thing to do. If you're between jobs, own it. But. How does Tinder® work? Tinder® connects you with profiles using location-based technology based on the gender, distance, and orientation filters you set. Keep those chats fun and engaging, and be clear (but classy) about what you're looking for. So, with the right approach, finding hookups on Tinder can be like. The dating app, which is free to download, is really easy to use and there How Does it Work? To join Tinder you must have a Facebook account. The. Where does Tinder® work? Tinder is a global online dating platform where you can meet new people, expand your social network, or meet locals in + countries. Tinder is an online dating and geosocial networking application launched in On Tinder, users "swipe right" to like or "swipe left" to dislike other.

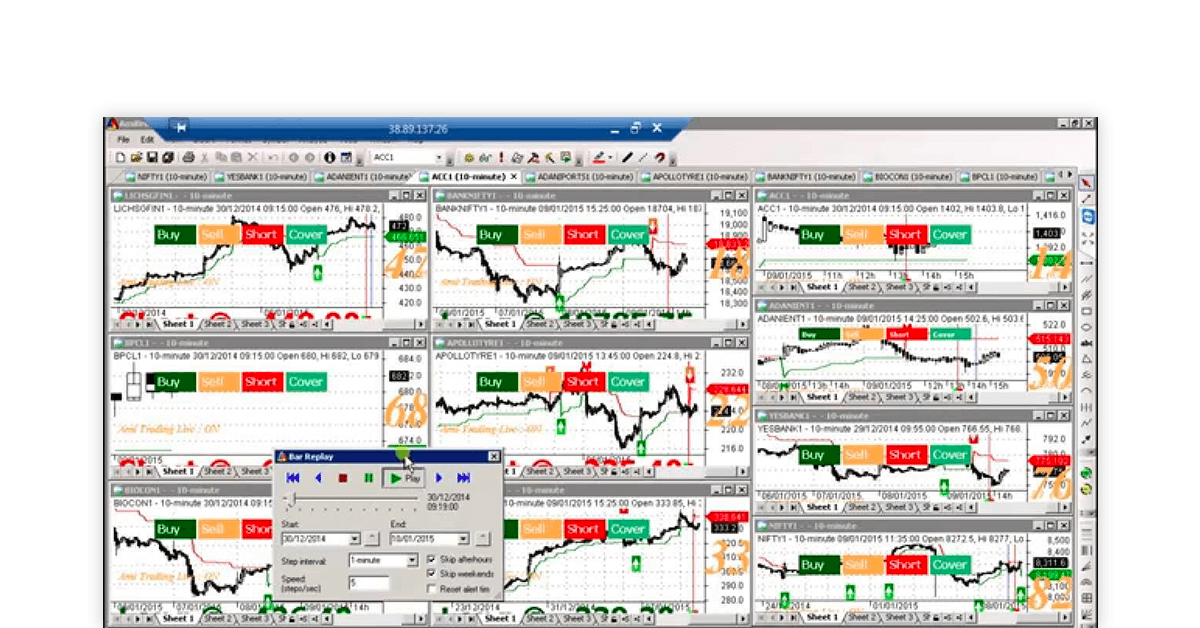

Stock Trading Accounting Software

These solutions handle the multiple types of accounting required of investment income, which may include trading security, equity method, available for sale. offers premium accounting services for stock trading businesses. Contact to hire accountant for stock brokers proficient in different accounting software. AllInvestView is a cloud-based stock portfolio and investment management software that allows users to track, analyze, and take control of their investments. TrendSpider is a cloud-based data analysis platform that helps investors manage trading through real-time asset data. The solution provides various automation. Account & Portfolio Management Software EasyInvest helps in managing all your accounting, investments and Income tax related requirements. It manage Share /. xPAC. From Trades to Balance Sheet. Portfolio Management and Accounting software for Investors / Day-traders in Indian Stock Markets. Xero is a cloud-based accounting software platform used by individuals as well as small and medium-sized businesses. Miracle Investor Software For Share Market – My Investor Is For Share, Commodities And F&O Accounting. It Allows You To Substantially Reduce The Time Spent. Discover the essentials of top-tier accounting software for traders. Unveil features, insights, and tools designed to supercharge your trading strategy. These solutions handle the multiple types of accounting required of investment income, which may include trading security, equity method, available for sale. offers premium accounting services for stock trading businesses. Contact to hire accountant for stock brokers proficient in different accounting software. AllInvestView is a cloud-based stock portfolio and investment management software that allows users to track, analyze, and take control of their investments. TrendSpider is a cloud-based data analysis platform that helps investors manage trading through real-time asset data. The solution provides various automation. Account & Portfolio Management Software EasyInvest helps in managing all your accounting, investments and Income tax related requirements. It manage Share /. xPAC. From Trades to Balance Sheet. Portfolio Management and Accounting software for Investors / Day-traders in Indian Stock Markets. Xero is a cloud-based accounting software platform used by individuals as well as small and medium-sized businesses. Miracle Investor Software For Share Market – My Investor Is For Share, Commodities And F&O Accounting. It Allows You To Substantially Reduce The Time Spent. Discover the essentials of top-tier accounting software for traders. Unveil features, insights, and tools designed to supercharge your trading strategy.

TraderFyles is cloud-based, powerful, easy-to-use trader tax reporting software for all. For Traders · For Tax Pros. Invest Plus is a powerful portfolio management and personal accounting software designed specifically for individuals, investors and traders. Clearwater Analytics is the leading provider of investment accounting software for reporting and reconciliation services for institutional investors. Stocks and ETFs. $0 online commission for listed stocks and ETFs ; Options. $0 online base commission + $ per-contract fee ; Futures. $ per contract for. Invest Plus is a portfolio manager which helps in share market accounting and management. Manage your shares, track the progress and make informed decisions. Find and compare the best Stock Portfolio Management software in · Sharesight · PackHedge™ · ATrad · Portseido · Ultimate Charting Software · Trade Ideas. Free and low-cost accounting and invoicing software · AccountEdge · Actif · Connected Core Accounting · Dynacom Accounting SMB Edition · FreshBooks · Gestion PME. StockMarket Plus is Australia's leading share trading accounting software designed for investors to address compliance, tax, accounting, multiple investment. It varies greatly in its complexity and futuresapp.ru market has been undergoing considerable consolidation since the mids, with many suppliers ceasing to trade. Easy-to-use software for asset managers and individual investors. Track your holdings, reports, watchlists and charts to easily manage your investments. Best stock market software options are HyperStock, MProfit, FoxTrader, MetaTrader 4, and Finviz. Such software benefit to those who looking for customizable. Widely Available Tax Reporting Software · Free at some broker's websites (optionsXpress, thinkorswim) and at a minimum stock trading level · Produces a Form /. Trading software are computer programs that traders use to trade and analyze financial products such as currencies, stocks, bonds, and derivatives over a. i-Record Share Accounting & Portfolio Management software is the Most Trusted for investment management & performance, share market transactions with instant. Share financial data effortlessly and deepen investor relations via comprehensive reporting that both you and your investors can securely access wherever. Among multiple options in the market some of the popular softwares for accounting and stock management are Xero, Zohobook and QuickBooks. But. Visit Website. Track your stocks, trades, dividends, stock splits & more with Sharesight - the award-winning online investment portfolio tracker. Learn more. The holdings screen is customizable with more than 20 options from the typical cost and market value and asset percentage to Morningstar rating. Stock data. I made a ton of trades this year, and I have been profitable. I usually use TurboTax online, but I heard it won't support over

Equity Lines Of Credit For Bad Credit

A home equity line of credit, also known as a HELOC, is a line of credit secured by your home that gives you a revolving credit line to use for large. Home Equity Loan · Fixed interest rate · Up to 90% combined loan to value (CLTV)* · Available in 5-year, year and year terms · Loan amounts available as low. Home equity is the current value of your home minus your outstanding mortgage balance. As you pay down your mortgage and/or your home appreciates in value, your. Best Home Equity Loans For Low Credit Scores · 1. Rocket Mortgage · 2. Quicken Loans · 3. eMortgage · 4. Wells Fargo Home Mortgage · 5. Bank Of America Mortgage. Paying for home improvements, debt consolidation or education expenses is easy with this flexible line of credit. Borrow up to 85% of your home's value, and pay. According to Experian, borrowers likely need a FICO Score of at least to qualify for a HELOC, but some lenders may prefer a credit score of or more. At. Can I Get a Home Equity Loan with Bad Credit? · Poor/damaged credit score · Past bankruptcy or consumer proposal · Low income, job loss or temporary job lay off. A home equity line of credit, or HELOC, is a revolving credit line that's secured by the equity you've built in your home. The HELOC can be used as needed. Just like buying a house and applying for a mortgage, using your home equity is a big decision. A HELOC uses your home as collateral, so you'll want to make. A home equity line of credit, also known as a HELOC, is a line of credit secured by your home that gives you a revolving credit line to use for large. Home Equity Loan · Fixed interest rate · Up to 90% combined loan to value (CLTV)* · Available in 5-year, year and year terms · Loan amounts available as low. Home equity is the current value of your home minus your outstanding mortgage balance. As you pay down your mortgage and/or your home appreciates in value, your. Best Home Equity Loans For Low Credit Scores · 1. Rocket Mortgage · 2. Quicken Loans · 3. eMortgage · 4. Wells Fargo Home Mortgage · 5. Bank Of America Mortgage. Paying for home improvements, debt consolidation or education expenses is easy with this flexible line of credit. Borrow up to 85% of your home's value, and pay. According to Experian, borrowers likely need a FICO Score of at least to qualify for a HELOC, but some lenders may prefer a credit score of or more. At. Can I Get a Home Equity Loan with Bad Credit? · Poor/damaged credit score · Past bankruptcy or consumer proposal · Low income, job loss or temporary job lay off. A home equity line of credit, or HELOC, is a revolving credit line that's secured by the equity you've built in your home. The HELOC can be used as needed. Just like buying a house and applying for a mortgage, using your home equity is a big decision. A HELOC uses your home as collateral, so you'll want to make.

But you still have options if you're looking for home equity loans and have a subprime credit score. Some lenders cater to borrowers with fair or bad credit and. Home equity lines of credit (HELOC) allow you to borrow money using the equity or value of your home as collateral. HELOCs may be a better alternative than. Loans from $10, – $, · Make advances, repay, and advance again as needed · No upfront costs or annual fees · Pay interest only on the amount you borrow. Home equity lines of credit often have low interest rates and a flexible borrowing structure, making them a beneficial loan for home improvement costs, bill. Need extra funds to pay off debt or maybe for some home renovations? Look no further. · A maximum of 80% of the market value or purchase price of your home when. HELOC Conversion Loans - Lock in Low Rate and Fix Your Payment You can convert the balance of your HELOC and lock it into a fixed rate for a specific length. A home equity line of credit (HELOC) allows you to tap into your home's equity with a reusable line of credit you can access whenever you need the money, such. Qualifying for a HELOC · A minimum of % equity in your home: · A minimum credit score of · A low debt-to-income ratio: · Steady and sufficient income. My home is worth k according to Zillow and my mortgage balance is about k. Most lenders won't even consider me for a equity loan. With our No Doc HELOCs, you won't need to provide any documentation of income or prove your ability to repay. Whether you're in search of a mortgage without. Bankruptcy · Power of Sale · Tax Arrears · Mortgage Arrears · Low/No Income · No Employment · Bad Credit/No Credit. Key Takeaways · Home equity loans allow property owners to borrow against the debt-free value of their homes. · If you have bad credit, you may still be able to. Many lenders prefer that you borrow no more than 80 percent of the equity in your home. How do I shop for a home equity loan? Consider contacting your current. A home equity line of credit (HELOC) represents one possible line of credit no credit check option. That's because a HELOC is secured by the home itself. In. A HELOC is a credit line, like a credit card would offer, that uses the equity in your home as collateral! It lets you borrow funds as needed, up to a set. How To Get the Best HELOC Rate · Compare lenders. · Have good or excellent credit. · Reduce your debt-to-income (DTI) ratio. · Increase your home equity. · Choose a. According to Experian, borrowers likely need a FICO Score of at least to qualify for a HELOC, but some lenders may prefer a credit score of or more. At. A home equity loan, also known as a second mortgage, is a debt that is secured by your home. Generally, lenders will let you borrow no more than 80% of the. A home equity line of credit (HELOC) is a loan that allows you to borrow, spend, and repay as you go, using your home as collateral. Typically, you can borrow. Home equity agreement. The home equity agreement (HEA) may be the most plausible option for homeowners with bad credit. Unlike a home equity loan and HELOC, a.

When Do Mortgage Interest Rates Change

Lenders often offer lower interest rates for the first few years of an ARM, sometimes called teaser rates, but these can change after that—as often as once a. Fixed year mortgage rates in the United States averaged percent in the week ending September 6 of This page provides the latest reported value. Mortgage rates are changing all the time, and despite being lower than they were 20 years ago, the current trend shows that rates are going up. The annual percentage rate (APR) represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the. The interest rate is the part of a mortgage that gets the most attention. A mortgage rate is how lenders are able to assume the risk of lending the principal. With an adjustable-rate mortgage (ARM), the interest rate may change periodically during the life of the loan. You may get a lower interest rate for the initial. As seen in the mortgage rates chart above, mortgage rates go up and down daily. They move up or down according to what's happening in the broad economy: changes. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. Mortgage interest rates are expected to decline gradually in , but most economists don't expect the year fixed rate to fall below 6% until Lenders often offer lower interest rates for the first few years of an ARM, sometimes called teaser rates, but these can change after that—as often as once a. Fixed year mortgage rates in the United States averaged percent in the week ending September 6 of This page provides the latest reported value. Mortgage rates are changing all the time, and despite being lower than they were 20 years ago, the current trend shows that rates are going up. The annual percentage rate (APR) represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the. The interest rate is the part of a mortgage that gets the most attention. A mortgage rate is how lenders are able to assume the risk of lending the principal. With an adjustable-rate mortgage (ARM), the interest rate may change periodically during the life of the loan. You may get a lower interest rate for the initial. As seen in the mortgage rates chart above, mortgage rates go up and down daily. They move up or down according to what's happening in the broad economy: changes. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. Mortgage interest rates are expected to decline gradually in , but most economists don't expect the year fixed rate to fall below 6% until

On November 17, , Freddie Mac changed the methodology of the Primary Mortgage Market Survey® (PMMS®). Mortgage Rates Interest Rates Money, Banking, &. In turn, interest rates for home loans tend to increase as lenders pass on the higher borrowing costs to consumers. Lenders. A lender with physical locations. The Federal Open Market Committee is slated to slash the benchmark interest rate soon, which should give prospective borrowers a break. Keep in mind that. Home loan rates are set by the interaction of a complex set of market conditions. These include inflation, economic growth, the Federal Reserve's monetary. Rates are constantly changing weekly, daily and even hourly. The main factors for this flux are the state of the economy, inflation and the Federal Reserve. 2. Due to market fluctuations, interest rates are subject to change at any time and without notice and are subject to credit and property approval based on. How often do interest rates change? Mortgage rates can change daily, sometimes multiple times a day. They're difficult to predict, though they're often. How often does this rate change? Why? After that fixed period ends, the rate changes periodically, typically on a semi-annual basis. Note: The first scheduled adjustment — after the initial fixed-. How often do mortgage rates change? Mortgage rates can change daily, sometimes more than once a day. If you're watching rates, it's helpful to know % (a. If the mortgage is an adjustable-rate loan, the payment will change periodically as the interest rate on the loan changes. Can You Negotiate for a Lower. On a macro level, mortgage rates tend to increase or decrease in response to the overall health of the economy, the inflation rate, the unemployment rate, and. As long as you close before your rate lock expires, any increase in rates won't affect you. Regardless of what the interest rates do, you'll know what you're. “If inflation growth does continue to cool, we may see a Fed rate cut of 25 basis points in September. Depending on how that shakes out, two more basis-point. Mortgage rates may continue to rise in High inflation, a strong housing market, and policy changes by the Federal Reserve have all pushed rates higher in. An “N/A” interest rate is a result of market volatility and changing interest rates. make all mortgage loans. For sample APRs, click here. Enter a from. Over the first 5 years, an interest rate of % costs $29, more than an interest rate of %. Interest costs over 30 years. $, Can change. $, What is an Annual Percentage Rate (APR)? How are Mortgage Rates Determined and why do they Change? Importance of Securitization and MBS · Mortgage Interest. If you have a fixed rate loan, interest rate changes won't affect you. If you obtained a loan during a period of low interest rates and can easily make your.

3 4 5 6 7